There are no monthly or maintenance fees with a 360 Checking account.

There’s no minimum deposit required to open, keep or use your account.

360 Checking doesn’t charge overdraft fees either. That's banking peace of mind.

Open a 360 Checking account in about 5 minutes

You’ll enjoy no monthly fees, no minimum required balance and no overdraft fees—plus a free debit card and access to more than 70,000 fee-free ATMs nationwide.

FREQUENTLY ASKED QUESTIONS

What is an online checking account?

360 Checking is a free checking account that comes with everything you need and without everything you don’t. Pay your bills, get cash, make deposits and transfer money—all without monthly fees and extra trips to the bank. You can open a 360 Checking account online and manage your money securely by signing in on your phone or computer, instead of waiting for the bank to open. And if you ever need help with your account, a real person is just a phone call away.

What are the fees associated with Capital One 360 Checking?

There are no fees to open, keep or use your Capital One 360 no-fee checking account, or for foreign transactions. There may be some things you want or need to do with your account that will result in charges. If you request a cashier’s check, send an outgoing wire or have a checkbook printed, you may be charged a fee for these extra services.

What if my account gets overdrawn?

You have several overdraft protection options to choose from: Auto-Decline, Free Savings Transfer, and No-Fee Overdraft.

- Auto-Decline: We generally decline transactions that cause overdrafts on your account.

- Free Savings Transfer: Automatic transfer of funds from your savings or money market account to cover overdrafts.

- No-Fee Overdraft: No fees charged on approved transactions that put your account balance below $0.

How do I earn interest with a checking account?

You can earn interest on the money in your account. As of 1/15/2026, if your online checking account balance is $9,999.99 or less, you’ll earn an annual percentage yield (APY) of NaN. If your balance is between $10,000–$24,999.99, you’ll earn a NaN APY on your entire balance. If your balance is between $25,000–$49,999.99, you’ll earn a NaN APY on your entire balance. If your balance is between $50,000–$99,999.99, you’ll earn a NaN APY on your entire balance. And if your balance is $100,000 or more, you’ll earn a NaN APY on your entire balance. Interest on your account will be compounded and credited on a monthly basis. Your account will only receive an interest posting if the amount earned during the month rounds to at least $0.01.

RESOURCES

Get closer to your financial goals

The Financial Success Hub offers tips and tools for your goals and financial health.

Explore the 360 Checking Feature Hub

Learn more about the many features at your fingertips with a 360 Checking account.

LOCATIONS

Find an ATM or Capital One location near you.

When you need us, we'll be there. Visit a Capital One Café, ATM, or branch near you.

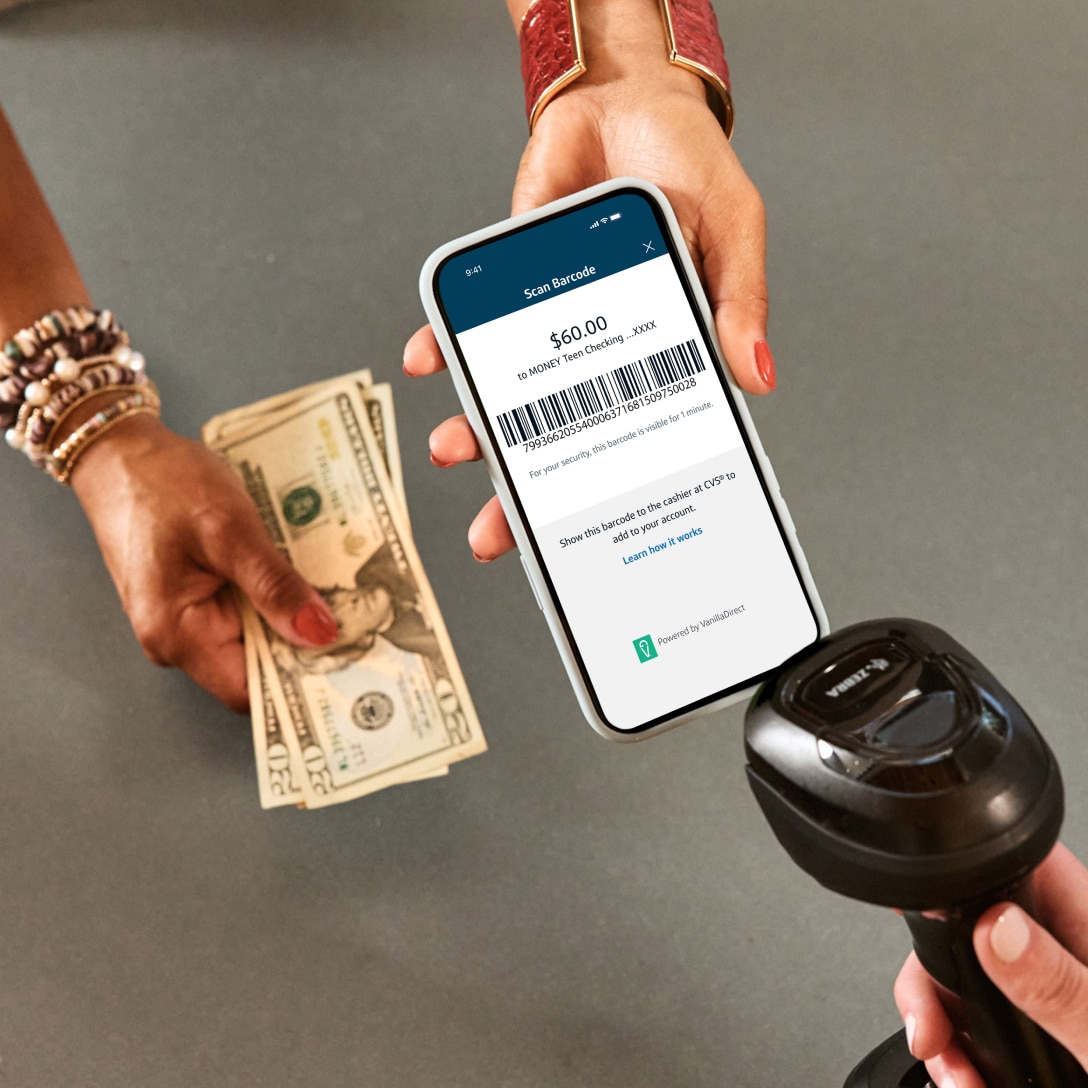

Not near us? No problem.