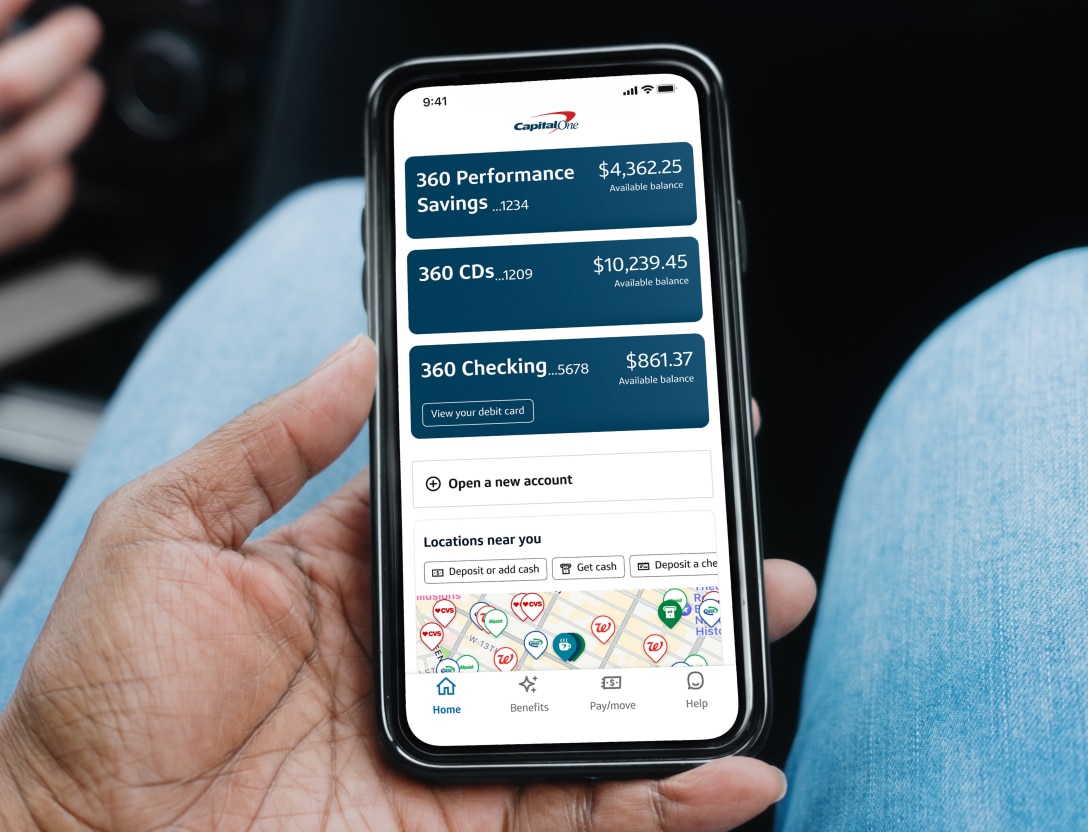

Bank online right from your phone

Capital One accounts feature easy-to-use online tools and a top-rated mobile app.

Start banking online today, it’s easy

Open a no-fee account featuring simple online tools and a top-rated mobile app, so you can bank when and where you want.

FREQUENTLY ASKED QUESTIONS

How does online banking work?

With Capital One online banking, you choose when, where and how to bank. You can access your account online or through the Capital One Mobile app. With banking security features and 24/7 access, your money is always at your fingertips. Web access is needed to use mobile banking, and mobile deposits are available only in the U.S. and U.S. territories. Remember to check with your service provider for details on specific fees and charges.

What are the advantages of online banking?

Thanks to online banking, you can manage your money anytime, almost anywhere. Use online bill pay to pay your monthly bills and mobile deposit to deposit checks using your mobile device’s camera and skip a trip to the bank. Plus, access other digital banking services like digital payments, automatic savings and CreditWise. Learn more about the benefits of online banking.

Are online banks safe?

All of Capital One’s bank accounts provide online banking capabilities, and we work hard to help keep you and your money secure. Your account is also insured by the FDIC up to allowable limits. Check out this article for tips on staying safe and secure when you bank online.

Please note that any Capital One or Discover Bank deposit accounts opened on or after the acquisition date are immediately counted with your other Capital One deposit accounts for determining deposit insurance coverage by the FDIC.

How do I set up online banking?

Capital One accounts include online banking for free. It’s simple and only takes about 5 minutes. You can open an account online or at a Capital One location.

RESOURCES

Bank online, on the go or in person

There are plenty of digital and in-person ways to bank with Capital One.