Pay Over Time

You have the flexibility to pay your balance in full or carry a portion of your balance with interest.

Pay Over Time

You have the flexibility to pay your balance in full or carry a portion of your balance with interest.

When it comes to your monthly payment,Pay Over Time gives you options.

You have the flexibility to carry a portion of your balance over to the next month with interest. You can also always pay your full statement balance by the due date—interest free.

1

Pay Over Time is available by invite on cards with no preset spending limit.

HOW IT WORKS

Make a purchase

Spend with confidence knowing you have flexible payment options.

Choose your payment

When it’s time for your monthly payment, pay any amount from your minimum payment up to your current balance.

Pay over time

If you carry a portion of your Pay Over Time balance, you’ll be charged interest on purchases from your previous billing cycle(s) up to your Pay Over Time Limit. 3

Avoid interest

You can avoid interest by always paying your statement balance in full by your due date each month.

PAY OVER TIME BASICS

Pay Over Time Limit

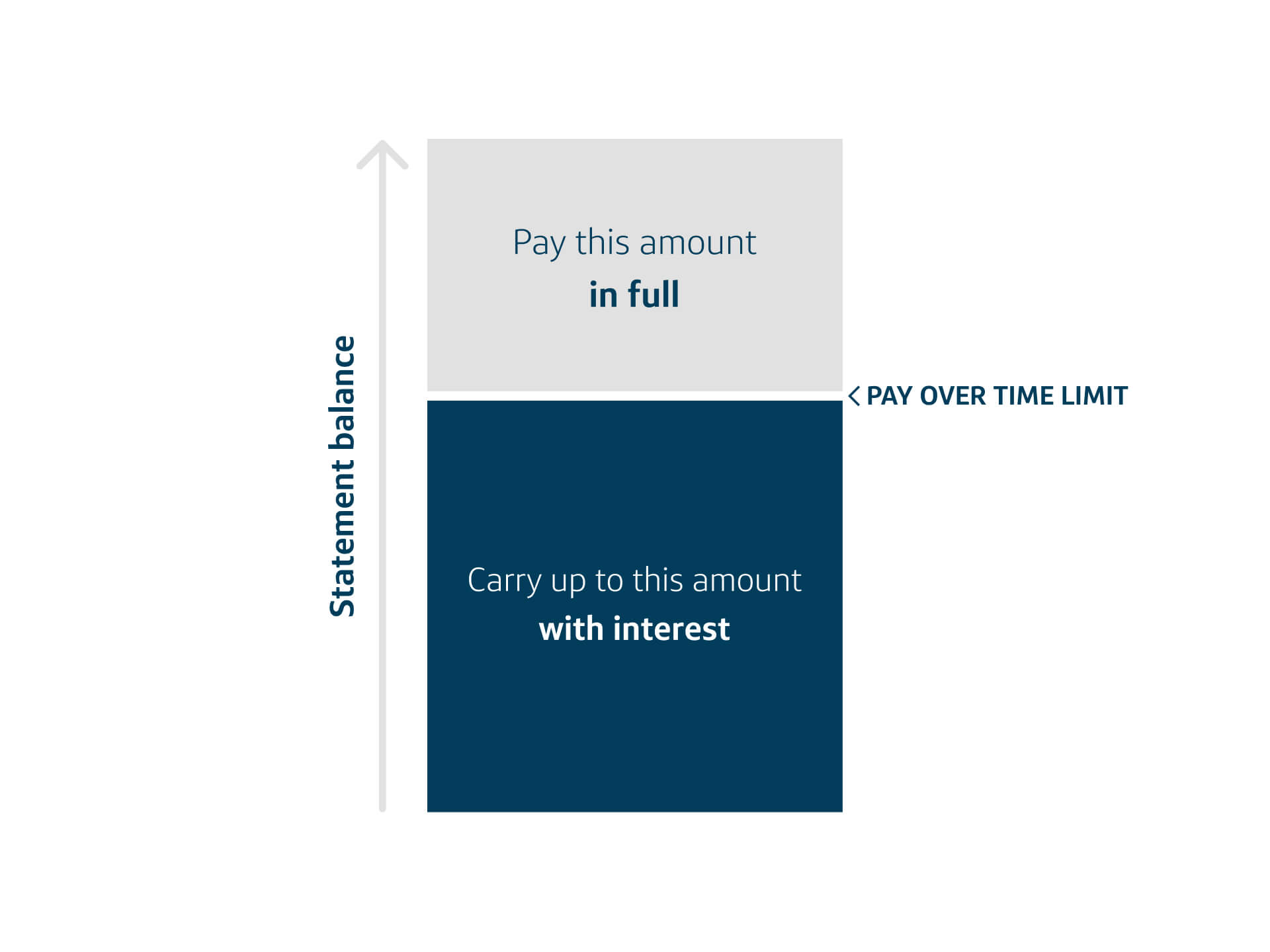

Pay Over Time gives you the flexibility to carry a portion of your statement balance with interest. The maximum amount you can carry over is called your Pay Over Time Limit and can be found in your account terms or statement. The Pay Over Time Limit is not a spending limit.

FREQUENTLY ASKED QUESTIONS

What is Pay Over Time?

Pay Over Time gives you the flexibility to carry a portion of your statement balance up to your Pay Over Time Limit with interest. The maximum amount you can carry over is called your Pay Over Time Limit and can be found in your account terms or statement. The Pay Over Time Limit is not a spending limit. More information on your purchasing power with no preset spending limit can be found here.

How do I use Pay Over Time to carry a balance on my card?

Pay Over Time doesn’t require any activation. To carry a balance on your card, simply make a payment that meets your minimum payment, but is less than your statement balance. At the end of the billing cycle, any remaining Pay Over Time balance will begin accruing interest at your Pay Over Time Purchase APR until paid in full.

Keep in mind your payment behavior, including carrying a balance, can impact your purchasing power. To maximize purchasing power, you should pay your statement balance in full and on time.

Where can I find my Pay Over Time Purchase APR and Limit?

You can find your Pay Over Time Purchase APR and Pay Over Time Limit on the Account Details page in your online account and on your monthly statement.

Will carrying a balance affect how much I can spend?

Your payment behavior, including carrying a balance, can impact your purchasing power. With no preset spending limit, your purchasing power will adjust over time based on your spending behavior, payment history, credit profile and other factors. To maximize purchasing power, you should pay your statement balance in full and on time.

To gain further insight into your current purchasing power, use the Confirm Purchasing Power tool.

How will Capital One report the no preset spending limit card with Pay Over Time to Experian®, Equifax® and TransUnion®?

Your card will be reported as a credit card account with the full payment due each month. Your Pay Over Time Limit is not a credit limit and will not be reported to the credit bureaus. Therefore, this account will not be considered in your credit utilization with revolving accounts.

How is my minimum payment calculated?

Your minimum payment is calculated as follows:

- If your balance is less than $25, your minimum payment will be equal to your balance.

- Otherwise, your minimum payment will be:

- The greater of $25 or 1% of your account balance (excluding the purchase balance in excess of your Pay Over Time Limit, new cash advance transactions, new interest, and new late fees) up to the Pay Over Time Limit

- Plus, 100% of your purchase balance in excess of your Pay Over Time Limit

- Plus, 100% of your new cash advance transactions, new interest, cash advance fees, and late fees

- We will also add any past due amount to your minimum payment. If your Account charges off, the entire balance is due immediately.

For an example of how min pay is calculated, see “Could I have an example on how minimum payment is calculated?”

Could I have an example of how my minimum payment is calculated?

For example, if your Pay Over Time Limit is $30,000 and your account statement “New Balance” is $50,000, your minimum payment would be calculated as follows:

- 100% of purchase amounts over your Pay Over Time Limit = $20,000

- Plus, if applicable, 100% of your new interest, late fees, cash advance, cash advance fees, and past due amount

- Plus, 1% of any remaining account balance up to the Pay Over Time Limit of $30,000 = $300

Resulting in a $20,300 minimum payment.

Can my Pay Over Time Limit change?

We reserve the right to change your Pay Over Time Limit and will notify you if this occurs.

- 1

Cards with Pay Over Time have a Pay Over Time Purchase APR and an assigned Pay Over Time Limit. Eligible purchase amounts up to the Pay Over Time Limit may be subject to interest if the total statement balance is not paid in full each month. Please refer to your Account Opening Disclosures and Customer Agreement for details.

- 2

Your Pay Over Time Limit is not your spending limit. You may be able to spend more than your Pay Over Time Limit. Any purchase amounts over your Pay Over Time Limit, new late and new cash advance fees and new cash advances must be paid in full by the statement due date each month. Please refer to your Account Opening Disclosures and Customer Agreement for details.

- 3

Purchase amounts that exceed your Pay Over Time Limit, new interest, new cash advances, and/or new late and new cash advance fees must be paid in full by your statement due date each month.