No preset spending limit

Purchasing power that adapts to your needs.

No preset spending limit

Purchasing power that adapts to your needs.

With no preset spending limit, your purchasing power is tailored to you.

Unlike a traditional credit card with a set limit, the amount you can spend adapts based on your spend behavior, payment history and credit profile. While not unlimited, most customers can unlock significantly more purchasing power with no preset spending limit than our fixed line credit card. If you have a card with Pay Over Time, additional payment options may be available. 1

No preset spending limit is available by invite on select cards.

FREQUENTLY ASKED QUESTIONS

What does “no preset spending limit” mean, and how does it affect my purchasing power?

With no preset spending limit, instead of having a fixed credit line, your purchasing power is tailored to you. While not unlimited, most customers can unlock significantly more purchasing power with no preset spending limit compared to our fixed line credit cards.

Purchasing power is the amount you could be approved to spend on your card at any given time. It can change over time based on factors such as your spend behavior, payment history and credit profile. You can maximize your purchasing power by spending more as well as paying your balance in full and on time, as these are important factors in setting your purchasing power. If you have a card with Pay Over Time, additional payment options may be available. 1

How much can I spend with no preset spending limit?

While not unlimited, most customers can unlock significantly more purchasing power with no preset spending limit compared to our fixed line credit cards. Your purchasing power will adapt based on factors such as your spend behavior, payment history and credit profile. You can maximize your purchasing power by spending more as well as paying your balance in full and on time, as these are important factors in setting your purchasing power.

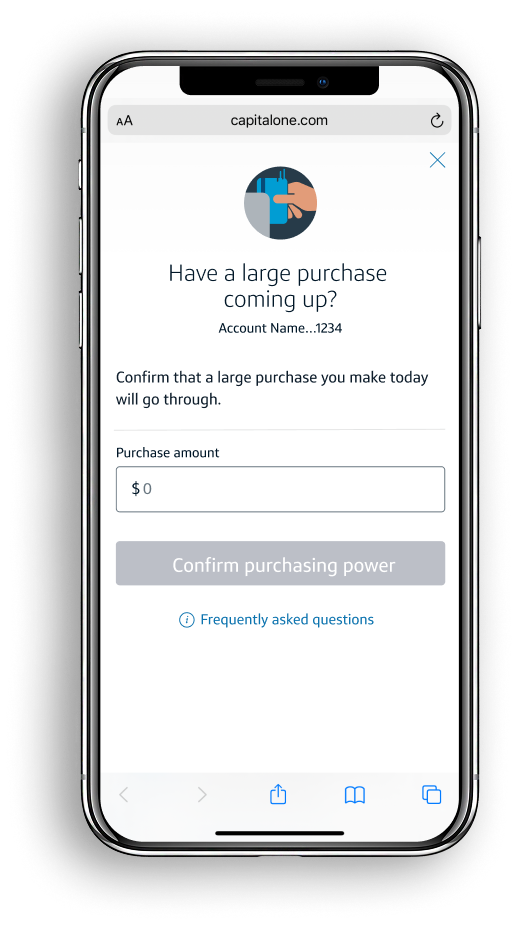

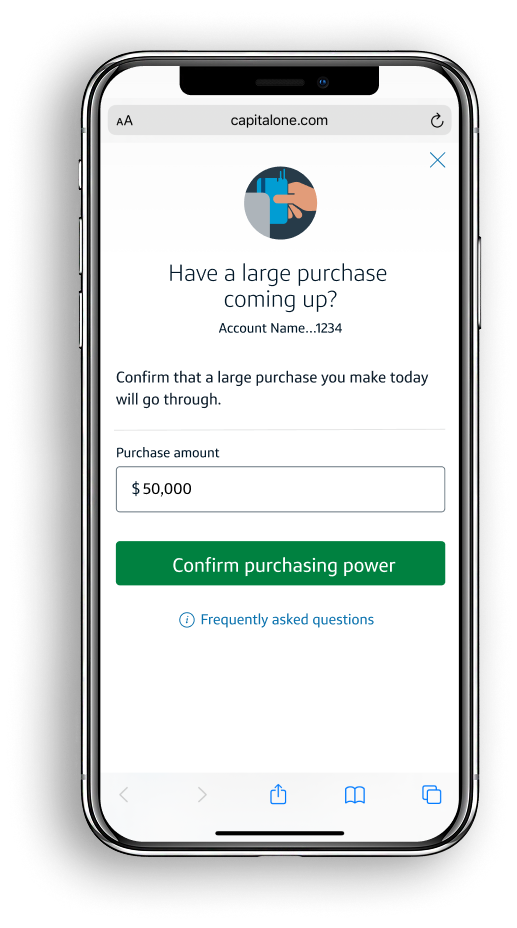

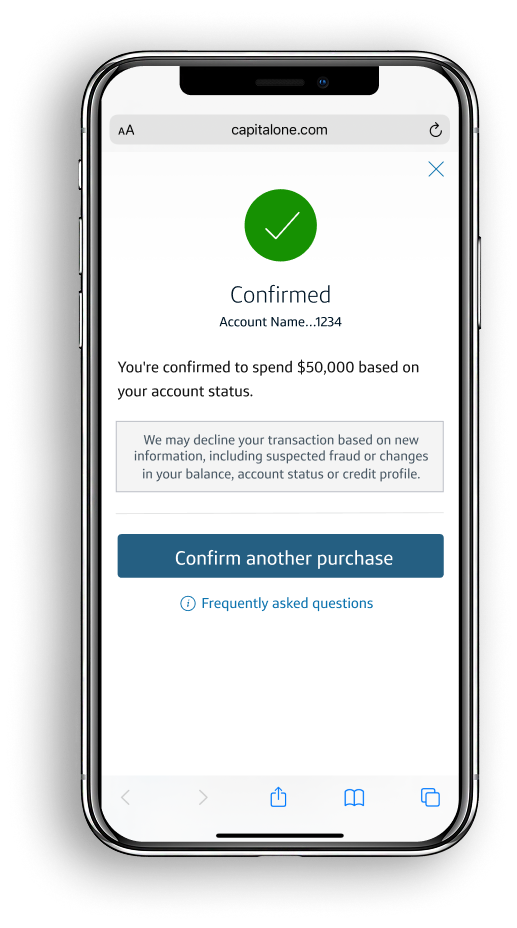

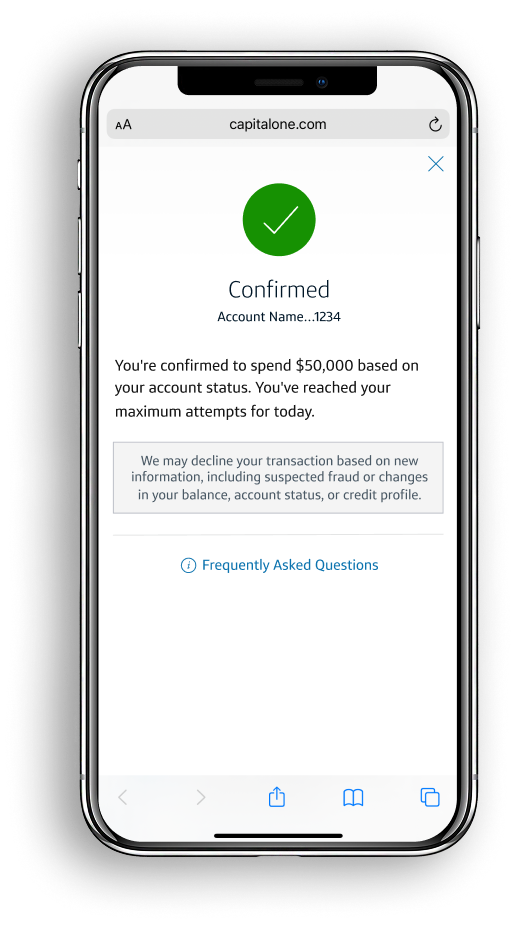

Our alerts can also help notify you when your purchasing power is low so you can make a payment and limit possible interruptions. To gain further insight into your purchasing power or check if a large purchase is likely to be approved, use the Confirm Purchasing Power tool.

Why might a transaction on a card with no preset spending limit be declined?

While declines on this card should be uncommon, they may occur if there are changes to your spend behavior, payment history or credit profile. As spend and payment history is a key factor for your purchasing power, you can often open up more purchasing power by making a payment. You can also use the Confirm Purchasing Power tool to check if an upcoming large purchase may be approved.

Cards with no preset spending limit may also be declined for suspected fraud. For help resolving these issues, you can respond to real time fraud alerts or call the number on the back of your card.

How will Capital One report the no preset spending limit card to Experian®, Equifax® and TransUnion®?

Cards with no preset spending limit will be reported as credit card accounts with the full payment due each month. No credit limit will be reported to the credit bureaus. Therefore, this account will not be considered in your credit utilization with revolving accounts.

How can I apply for a card with no preset spending limit?

Currently, no preset spending limit cards are available by invitation only.

- 1

If you have a card with no preset spending limit, failure to pay your minimum payment each month by your statement due date may result in suspension of charging privileges, a late fee, negative credit bureau reporting and possible default. Refer to your Customer Agreement for details.

- 2

Using the confirm purchasing power tool does not guarantee that your transactions will be approved. Transactions may be declined due to suspected fraud, changes in your account balance, changes in your account status, credit profile or other factors.