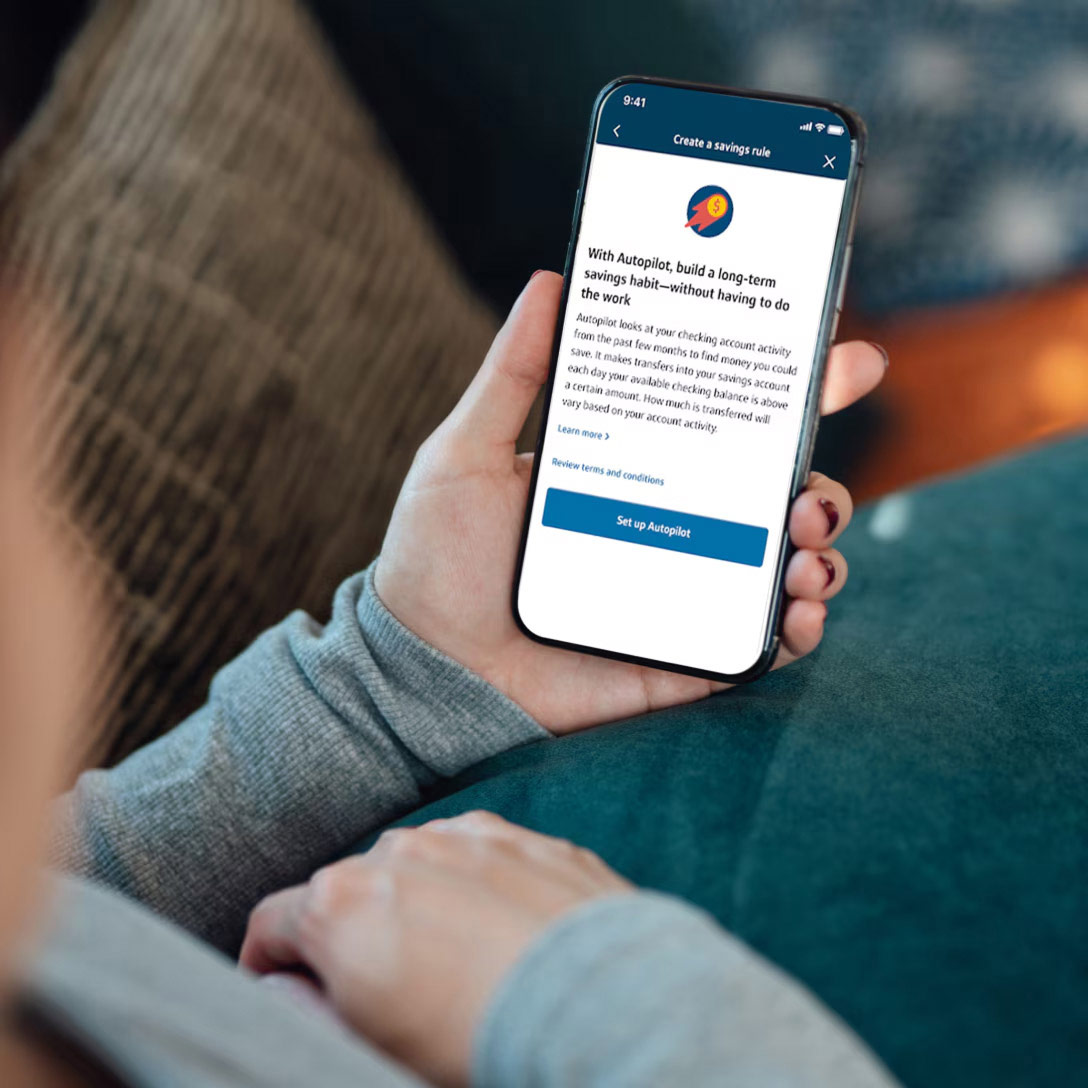

Set it up

Create savings rules directly in the app.

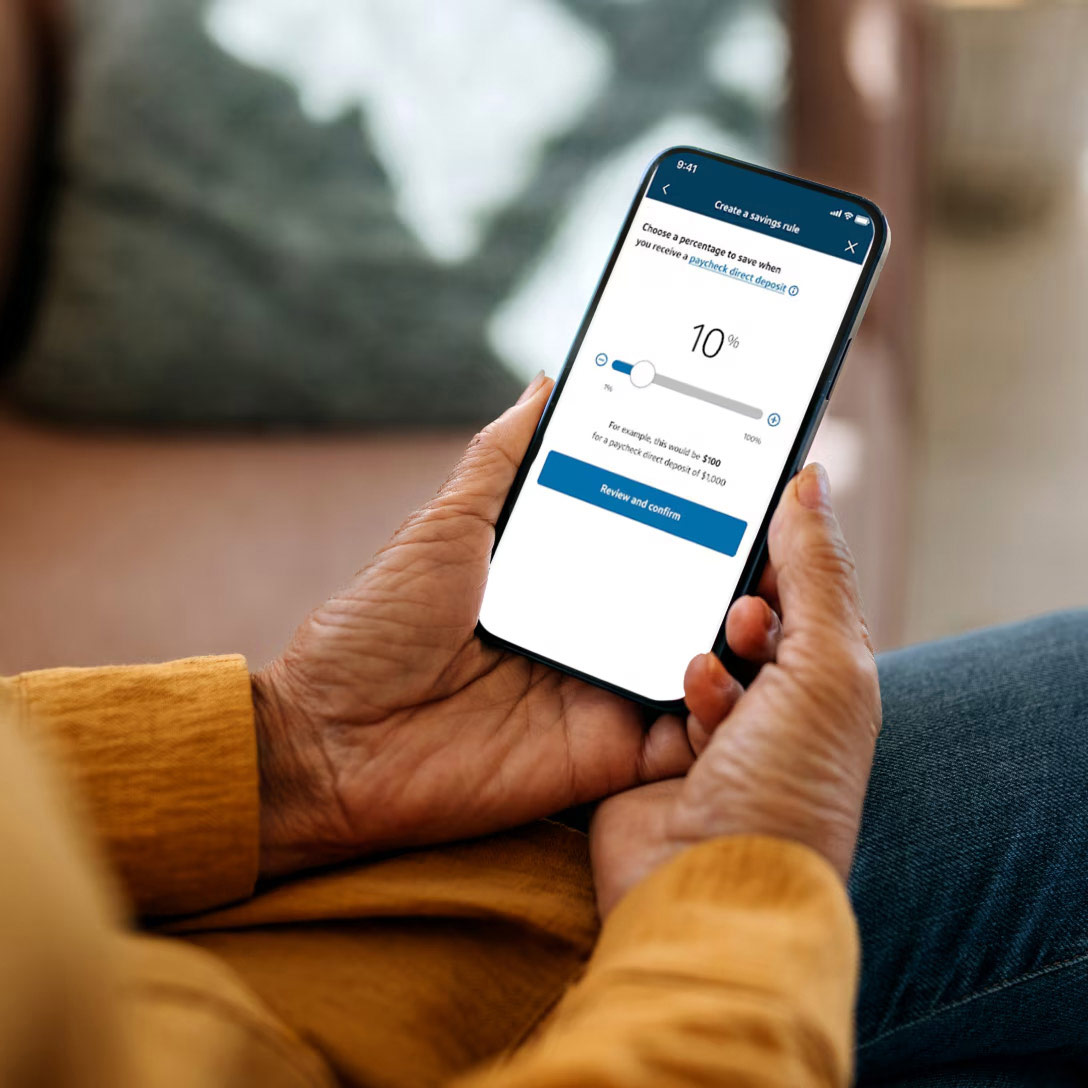

Save your way

Choose how much and how frequently you want to save.

Watch it grow

Sit back, relax and keep on saving.

AUTOMATIC SAVINGS TOOLS

Autopilot makes daily small-dollar transfers to your savings account—from a few cents up to $15, based on your recent checking account activity—each day your available checking balance is above a certain amount.

With recurring transfers, you can make regular transfers from your Capital One or external checking account to your Capital One savings account. Choose an amount, a start date and how often: weekly, biweekly, monthly or quarterly. It’s up to you.

Paycheck percentage lets you save a portion of every payday. Choose a percentage from each paycheck’s direct deposit to automatically deposit into your savings account.

Start saving automatically for what matters most

Find out how easy it is to save with Automatic Savings tools from Capital One.

FREQUENTLY ASKED QUESTIONS

What accounts do I need to access Automatic Savings tools?

A Capital One savings account is required to use Automatic Savings tools. Autopilot and paycheck percentage require a Capital One checking account to use, while you can set up a recurring transfer from either a Capital One checking or external checking account, like the accounts listed below:

-

Checking accounts—360 Checking, Total Control Checking, MONEY Teen Checking (only recurring transfers or paycheck percentage) and external checking accounts for recurring transfers.

-

Savings accounts—360 Performance Savings, 360 Savings, 360 Money Market, Confidence Savings, Savings Now and a Kids Savings Account.

Can I set up multiple rules at the same time?

Yes, you can set up multiple recurring transfer and paycheck percentage rules, as well as one autopilot rule, per checking account. After you sign in, choose your checking or savings account that you’d like to use to set up the rule, scroll down to select Automatic Savings and then View Automatic Savings. From there, choose the savings rule and set your saving preferences.

Can I remove or edit an Automatic Savings rule?

Yes, you can remove or edit your Automatic Savings rule(s) at any time. Just sign in with the Capital One Mobile app, choose your checking or savings account, scroll down and select Automatic Savings to view your current rules. Then, choose the one you’d like to remove or edit.

Which savings rule is right for me?

Each savings rule is a great way to grow your money. However, one rule may make more sense depending where you are on your financial journey. Here are a few examples to help you decide which is right for you.

-

Autopilot can work well when you want to save a little each day, but don’t want to dip below a specific checking amount set by you.

-

Recurring transfers can work well when you have a good sense of a safe, specific amount to pull from your checking account on a regular basis. Recurring transfers between Capital One accounts happen instantly, while transfers between Discover accounts and Capital One accounts may take longer. External transfers can take 2-3 business days.

-

Paycheck percentage can work well when you have a “pay-yourself-first” mentality. In other words, you want a percentage of how much you’re paid to automatically go toward savings first, and then the rest of your paycheck can go towards other expenses.