Car Buying Outlook

About the Car Buying Outlook

The 2025 Capital One Car Buying Outlook surveys car buyers and dealers on the perceptions and tools that shape the car buying experience.

FROM SANJIV YAJNIK

Online information plus in-person connection creates a better experience

"We're living in a time when digital information is everywhere, but it's the combination of that knowledge with meaningful in-person experience that truly empowers car buyers," says Sanjiv Yajnik, President of Capital One Auto. "When people shop online and then connect with a trusted dealer, they are more confident and more delighted with the outcome. The blend of transparency, technology and human connection is what makes this such an exciting moment for our industry."

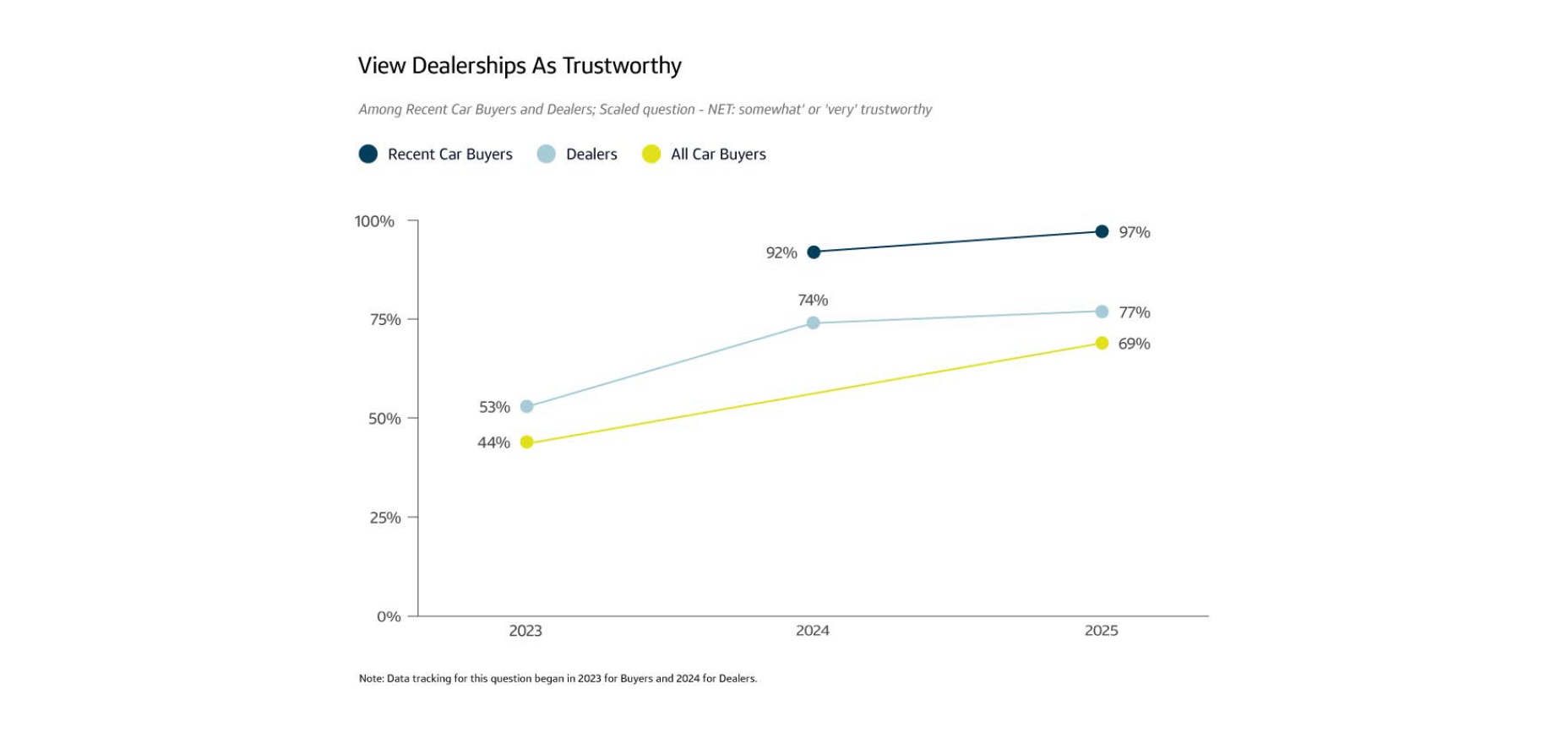

TOOLS THAT FOSTER TRUST

Digital tools can build trust and transparency

The availability of digital tools contributes to trust and transparency, and dealers are recognizing the potential benefits.

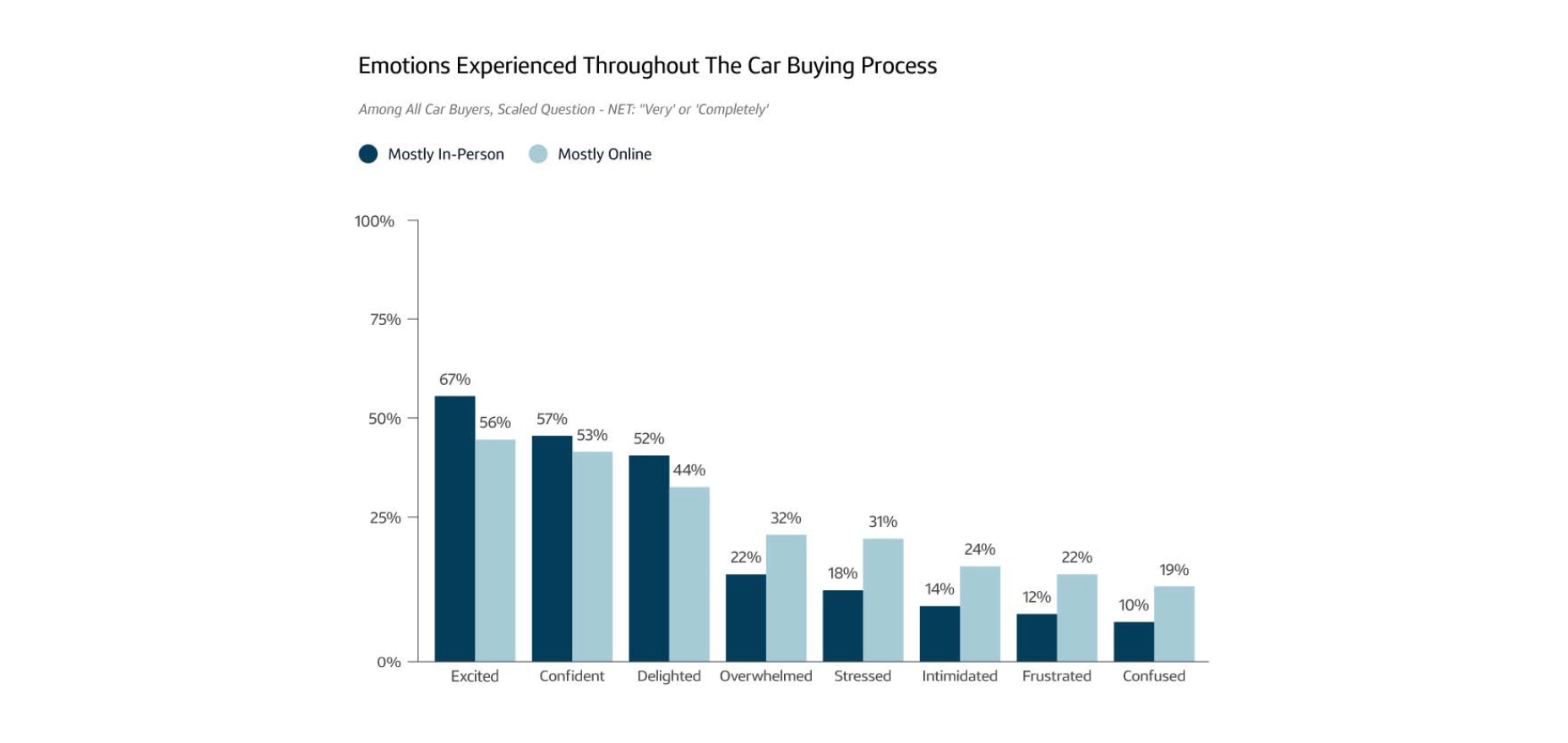

SATISFACTION AND CONTROL

In-person shoppers more likely to feel excitement

Shopping with both online and in-person resources is the norm, and though many car buying experiences “start digital,” personal interaction between buyers and dealers corresponds to more positive emotional responses.

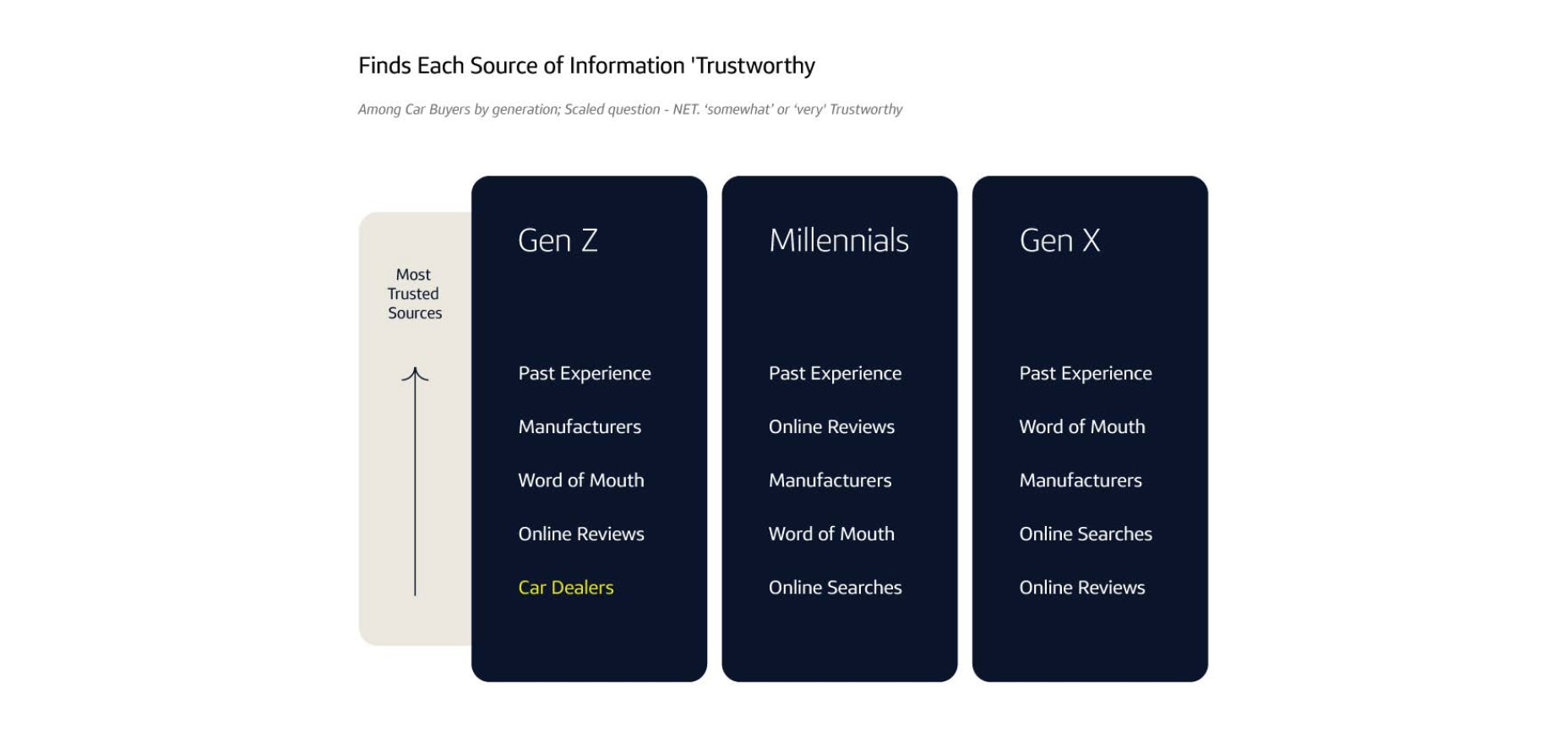

THE RISE OF GENERATION Z

Gen Z reports higher trust in dealers

The latest generation to embark on first-time car buying is more likely to trust dealers, and they’re also open to external information from sources such as third-party websites in making decisions.

Previous Car Buying Outlook Reports

2024 Car Buying Outlook

Trust in dealers – not vehicle price – clinches the deal for nearly half of America’s car buyers

2023 Car Buying Outlook

Car buyers agree that dealer adoption of digital tools makes the car buying experience more transparent

The 2022 Car Buying Outlook

Car buyers embrace more digitized experience before heading to the dealership

Related Content

EV Hub

Capital One EV Hub helps car buyers understand the world of hybrid and electric vehicles to make a more informed decision about sustainable vehicle options.

Keys to the American Dream

President of Financial Services at Capital One Sanjiv Yajnik shares one key to more economic opportunity is owning a car

For more information, contact:

Stephanie Friswell - Director

About the Survey

The Capital One Car Buying Outlook consists of findings from two surveys targeted to car buyers and dealers respectively, both of which were conducted on behalf of Capital One Auto Finance through Rep Data. Diagnostic tests (panel-level, statistical, logic-based, refielding) were conducted to remove low-quality respondents and ensure the integrity of the final sample.

The analyzed buyer survey was conducted online from August 12 through August 24, 2025 with a margin of error of +/-2.2%. The analyzed car buyer survey consists of 2,042 U.S. car buyers (recent and future), ages 18+. Of these, 829 purchased a car in the last six months and are considered “current car buyers”, while 1,213 said they’re planning to purchase a car within the next year and are considered “future car buyers”. Generational data was pulled for Boomers and older (ages 61+) Generation X (45-60), Millennials (29-44) and Generation Z (18-28).

The analyzed dealer survey was conducted online in two parts, from August 11 through August 22, 2025 and September 15 through September 17, 2025 with a margin of error of +/-4.4%. The analyzed dealer survey consists of over 489 U.S. car dealers. These respondents currently work for an automobile dealership as an owner, general manager, F&I director, sales manager, internet manager or in the business development center at dealerships with an approximate annual sales volume of at least $1M.

Findings are compared to the 2024 Car Buying Outlook (fielded between May 1-20, 2024 to 1,994 U.S. recent car buyers with a margin of error of +/- 2% and 600 U.S. car dealers, with a margin of error of +/- 4%), the 2023 Car Buying Outlook (fielded between October 10-15, 2022 to 2,210 U.S. recent and future car buyers with a margin of error of +/- 2% and 400 U.S. car dealers with a margin of error of +/- 5%), the July 2022 Car Buying Outlook (fielded between June 7-13, 2022 to 2,209 recent and future car buyers with a margin of error of +/- 2% and 400 car dealers with a margin of error of +/- 5%), and the 2021 Car Buying Outlook (fielded between October 1-20, 2020 to 1,000 future and recent car buyers with a margin of error of +/- 3% and 401 car dealers with a margin of error of +/- 5%).

All data in this report is from self-reported, anonymous research of U.S. respondents broadly, not specifically from or about Capital One customers or employees.