Get more out of your card

Here's everything you need to know about your card with no preset spending limit.

Get more out of your card

Here's everything you need to know about your card with no preset spending limit.

Tips to Manage Your Card

Train your card to grow with you

With no preset spending limit, your purchasing power adjusts based on your spending and payment behaviors. 1 The more you use it, the more it learns about your needs.

Pay in full to unlock purchasing power

Paying down your balance more frequently can help grow your purchasing power over time. 2

Payments are accepted instantly

When you make a payment, your funds are immediately applied to your purchasing power so you can keep spending. 3

How does no preset spending limit work?

As you use your card, your purchasing power adapts to your needs based on your spending behavior, payment history, credit profile and other factors.

Frequently Asked Questions

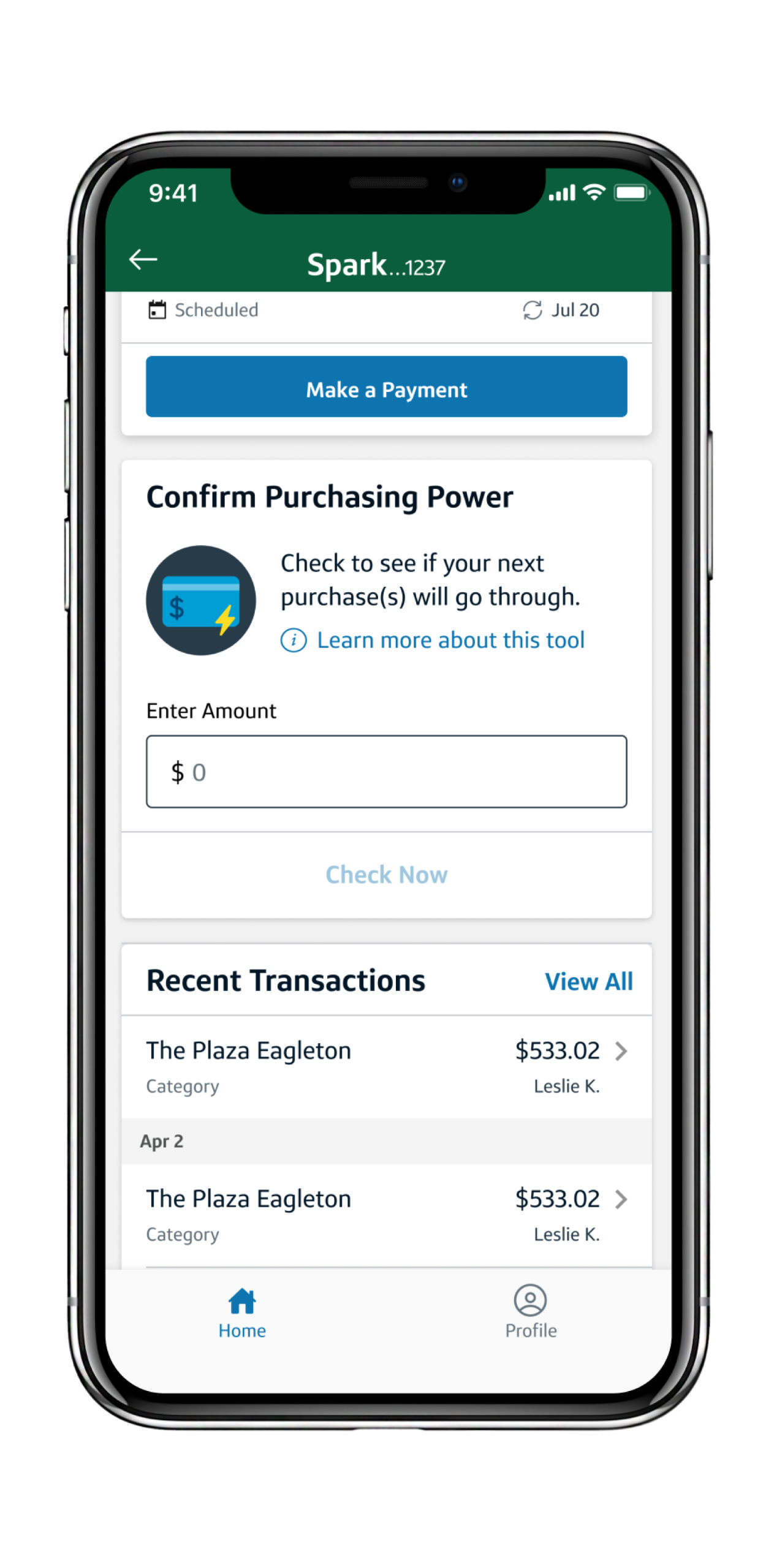

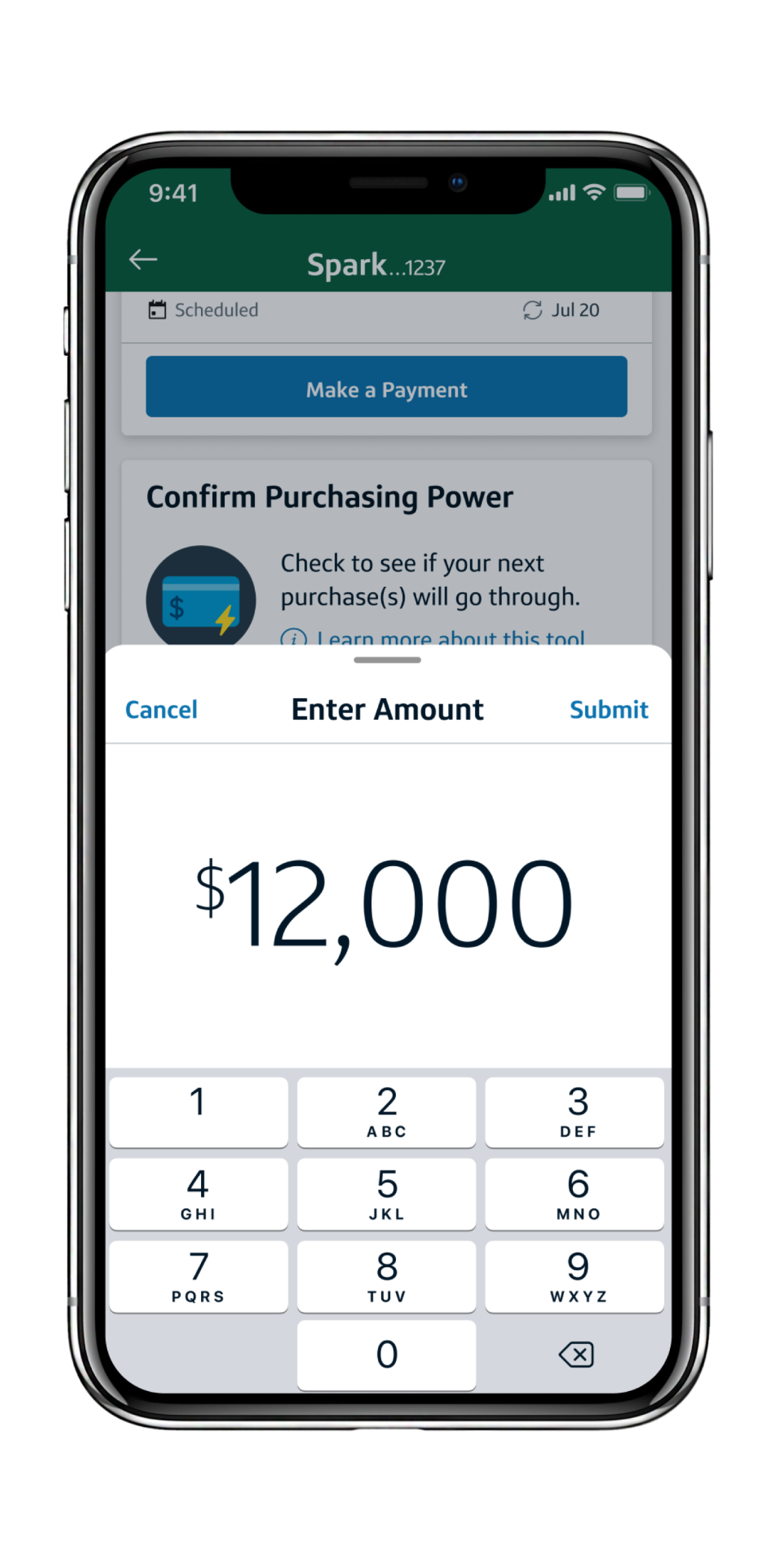

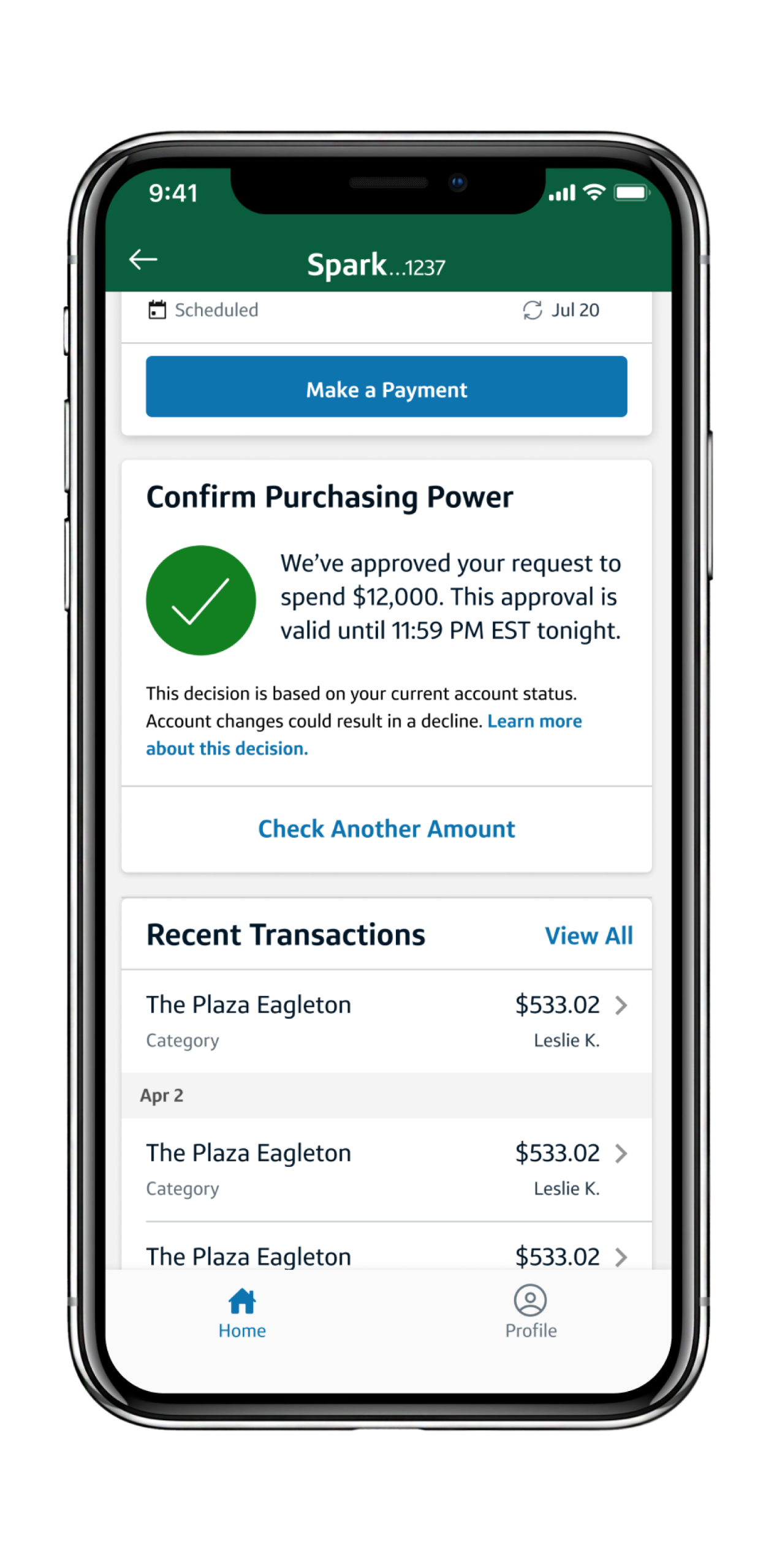

How much can I spend?

This card has no preset spending limit. While there is no predetermined spending limit, this does not mean unlimited spending or that you have no limit. The amount you can spend can change over time based on your spending behavior, payment history, credit profile and other factors. You can confirm your purchasing power in your online account for peace of mind with large purchases.

Will my rewards expire?

Your rewards are yours for the life of the account—they will not expire. But if your account is closed, you will lose any rewards you have not redeemed.

Is there a limit to the amount of rewards I can earn?

There is no cap to the amount of rewards you can earn on purchases.

What are the benefits of my Capital One Business card?

From unlimited rewards to free employee cards, your Capital One Business card comes with the perks and tools you need to get business done. View all Capital One Business card benefits.

- 1

No preset spending limit does not mean unlimited spending. The amount you can spend can change over time based on your spending behavior, payment history, credit profile and other factors.

- 2

Your purchasing power is dynamic and your payment's impact on purchasing power is subject to change.

- 3

Your access to real-time funds availability is based on your payment and purchase history and your credit profile, and is subject to change. It may not be available for every payment via every channel and is subject to frequency limitations. Capital One reserves the right to remove access to this feature as determined by Capital One in its sole discretion.

- 4

Changes in our assessment of your credit worthiness or changes in your account status due to factors such as returned payments, past-due balances, or fraud may affect confirm purchasing power decisions and result in a decline.