Why Are Cars So Expensive Right Now?

Vehicle prices today have economic and industry factors that could determine your next purchase.

Adobe Stock

Adobe Stock

Article QuickTakes:

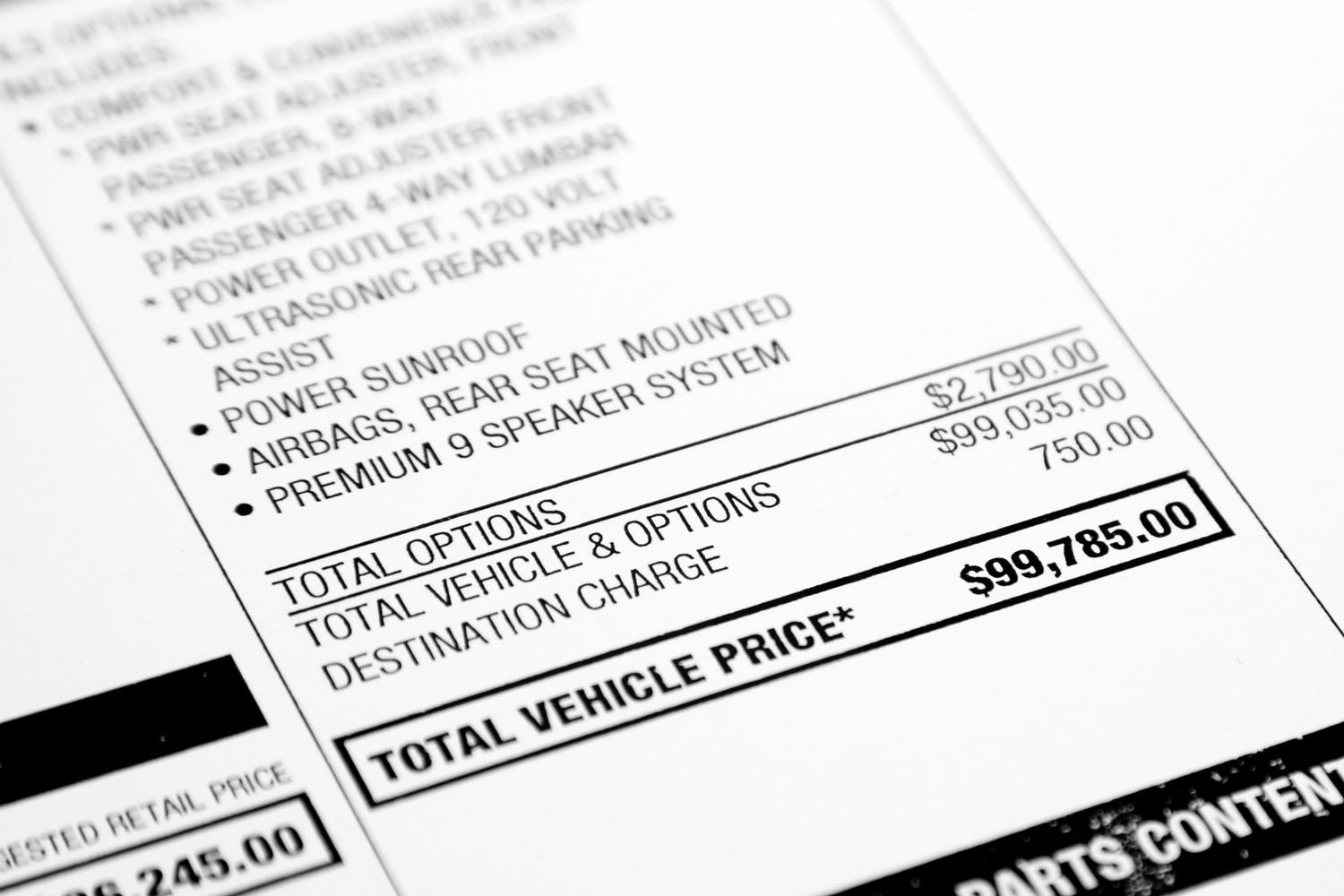

If you've experienced sticker shock while shopping for a new car recently, you're not alone. New-car buyers in 2023 pay an average of $717 a month for their vehicles, according to Edmunds. But why are cars so expensive right now?

Inflated prices, elevated interest rates, and supply chain restrictions have directly impacted your car's price tag. By taking a look at current price trends and the factors that created them, you can make an informed decision on whether now is the right time to buy your next car.

Buying a Car Today Is More Expensive Than Ever

In 2022, 15.7% of drivers committed to paying more than $1,000 a month for their new cars. This percentage is the highest it's ever been, up from 10.5% and 6.7% in the fourth quarter of 2021 and 2020, respectively. Even 5.4% of used vehicle buyers agreed to pay more than $1,000 a month in 2022.

These elevated monthly payments leave consumers facing a financial dilemma when it comes time to buy a car. New car prices are up 4.2% year over year, which means people are taking more out of their budget to afford their ride.

The price of owning a car has also increased, going from an average yearly cost of $9,666 in 2021 to $10,728 in 2022. That's a change of almost $90 a month in operating costs alone. These prices can cost owners thousands over the lifetime of their cars.

What Is Impacting Car Prices?

The automotive industry was directly affected by consequences of the COVID-19 pandemic. Unable to build and sell the products they needed for the last few years, automakers are slowly attempting to recover amidst difficult financial times.

Another major impact the pandemic had on the auto industry was supply chain restrictions. With a lack of semiconductor chips, vehicles sat idle on lots. This boosted demand while squashing inventory.

According to the most recent

Should I Buy a Car Right Now?

Taking these factors into consideration, you may be wondering if it's worth it to buy a car right now. The truth is, it depends on your circumstances. For example, if you own a car, it could be a great time for you to trade it in for a new ride.

While new car prices may be high, leveraging your used car to offset costs could help you afford your next purchase. Used cars have more positive equity than usual right now. Since the pandemic, cars have experienced an adjusted depreciation, with higher mileage cars selling for more than before. This increased value means you might be able to capitalize on your car's equity by trading it in to offset high new-vehicle prices.

If you don't have a used car to trade in, current car prices could be outside of your budget. Before you decide whether buying a car is the right move, try calculating your monthly payment and looking at some financing options to see what your projected costs might be. You may discover prices are more within reach than you expected or, alternatively, that it might be better to wait.