How Rising Interest Rates Affect How Much Car You Can Afford

Higher car loan rates can create a gap between what you want and what you can afford.

Shutterstock

Shutterstock

QuickTakes:

When you're shopping for a home, adding 1 percent to the interest rate can decrease your buying power by up to 11 percent. That means a buyer who qualifies for a $500,000 loan when interest rates are 3 percent could see their pre-approval fall below $450,000 when mortgage rates climb to 4 percent.

When it comes to buying a new or used car, that same interest-rate increase will also hit you in the wallet, although it might not be as obvious. After years of consumers enjoying low-interest loan rates, the cost of borrowing for larger life purchases like a home or car has started to creep up. According to the CME Group risk management firm, there could be as many as eight interest rate hikes in 2022 and 2023 as the Federal Reserve attempts to curb inflation, which is already expected to be over seven percent.

Rising Interest Rates Pile on Top of High Car Prices

As of the start of 2022, the average new vehicle costs just over $47,000. That price will buy you a nicely equipped mid-size SUV, such as a 2022 Toyota Highlander that starts at $36,620 including destination fees. Or maybe, like me, you daydream about buying a long-range 2022 Tesla Model 3, which starts at $47,690.

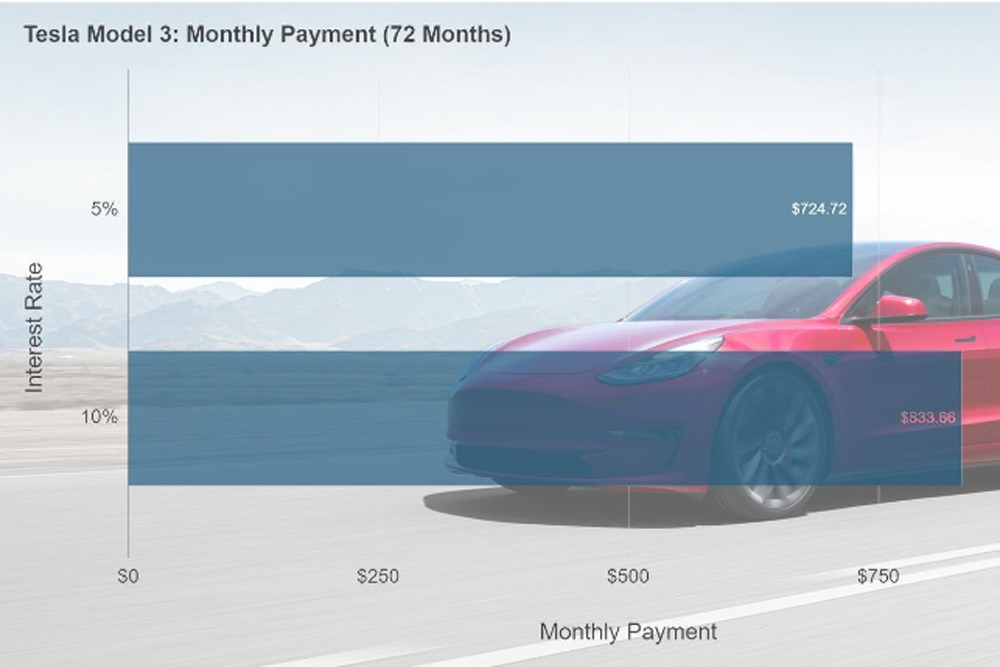

Based on a 72-month loan with a $2,000 down payment and a 5 percent interest rate, a $47,000 vehicle would have you making monthly payments of $725. A 1 percent increase in the interest rate would boost that by $21 a month, which adds up to a serious sum of money—more than $1,500 over the course of the loan.

Tesla / Capital One

Tesla / Capital One

As Interest Rates Change, so Do Your Monthly Car Payments

What if the threat of higher interest rates comes to fruition?

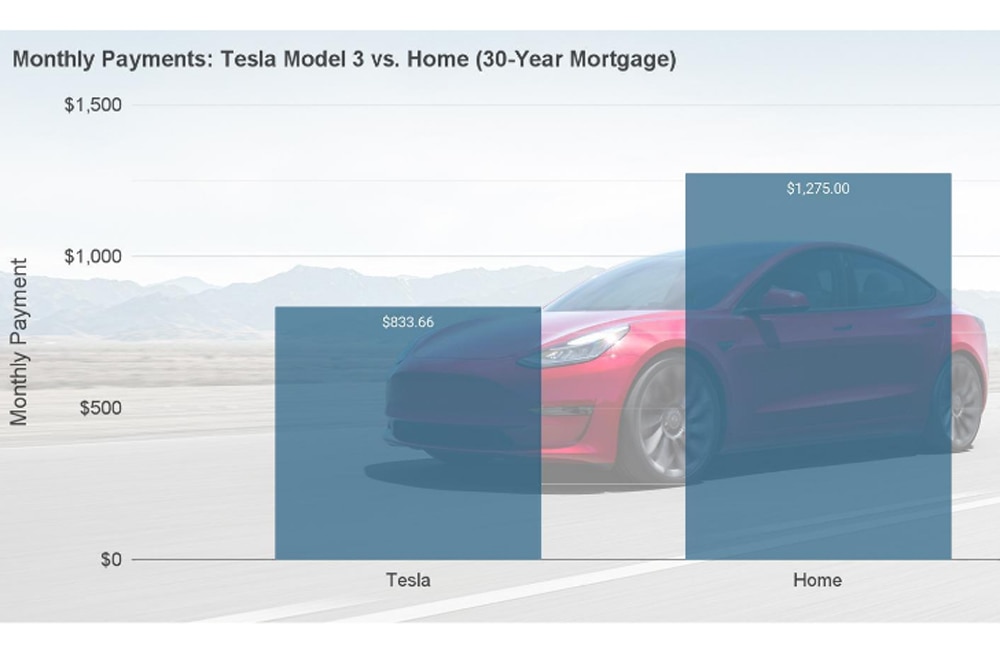

If the rate for that average-price new truck or SUV increases from 5 to 10 percent annually, your new monthly car payments will now accelerate to over $10,000 a year (or $834 per month). That’s more than 65 percent of the average monthly payment on a 30-year fixed home mortgage.

Tesla / Capital One

Tesla / Capital One

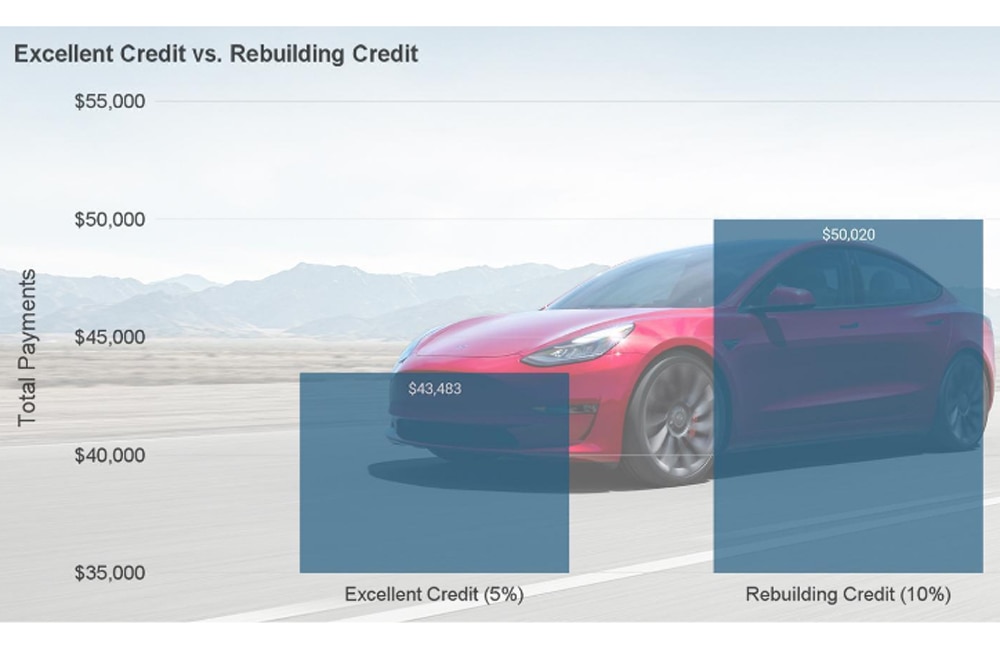

That higher interest rate also adds up faster than you can imagine on the average new car. The 10 percent rate will cost you over $1,300 a year in extra interest payments versus when the interest rate was only 5 percent. Over a six-year loan you’re now paying over $7,800 more for your “average” new car.

Ways to Lower your Car Payment

Beyond hunting for the lowest available car loan rates, there are other ways to keep your monthly payments affordable as interest rates climb. Putting down a larger down payment will reduce the amount loaned for starters. You can also honestly address your transportation needs. With so many people now working at home and no longer needing a large and comfortable vehicle for the daily commute to the office, maybe a smaller or less-expensive vehicle is all the car you really need.

A car that is $15,000 out the door, which is doable on a brand new 2022 Chevy Spark, would require a near-doubling of its interest rate, from 5 to 9 percent, to see a mere 10 percent increase in its monthly payment if you chose a five-year loan. That monthly payment works out to less than $10 a day with a 5 percent interest rate, giving you a monthly payment of $283. A 9 percent interest rate would increase that payment to only $311.

Chevrolet / Capital One

Chevrolet / Capital One

That difference is less than thirty bucks a month or barely 95 pennies a day. That’s not too much of a squeeze if you’re tight with the dollar. Small loans lead to small payments that you can pay quickly with less stress.

Look for a Longer New-Car Warranty

Beyond that new car smell, one of the biggest reasons a car buyer chooses new over used is the insurance against costly repairs that comes with a factory bumper-to-bumper warranty. The typical new car warranty is three years or 36,000 miles, whichever comes first. But some automakers offer more extended coverage, such as Hyundai's five-year/60,000-mile program. Matching the length of your car loan to your vehicle's comprehensive coverage can help fix your monthly costs.

Your Financial History Can Also Affect Your Car Loan Rate

Being practical with your car purchase and staying tight with your money can help. But your credit history can also play a big factor in the loan rate you get.

Tesla / Capital One

Tesla / Capital One

That $7,800 in extra payments we mentioned earlier? That comes from a higher interest rate which is charged to a car shopper who is rebuilding their credit history.

Let’s assume you’re pursuing an excellent credit history that will lead to that rock-bottom interest rate on a new car. To get an even lower rate, you may also want to ask a friend or family member who also has an excellent credit score to co-sign on the loan.

Leasing Can Lower Your Short-Term Payments, but at a Long-Term Cost

While we've focused on loan rates, another way to lower your monthly payments and get all the car you want is to lease the vehicle. Buying a car involves higher monthly finance costs, but you own an asset—your vehicle—when the loan is paid off. But a lease is like a long-term rental. You only pay for the time you use the car.

The result is lower monthly payments, and you can often drive a vehicle that may be more expensive than you could afford to buy. But be aware: you may get into a cycle where you never stop paying for a car.

Interest rates can either supercharge your buying power or throttle it back. Do the best you can to seek out the best rate, protect your credit score, save your money, and invest well in your automotive future.

* Interest rates mentioned above are examples and not meant to be representative of the market.

Written by humans.

Edited by humans.

Steven Lang

Steven LangSteven Lang is a special contributor to Capital One with nearly two decades of experience as an auto auctioneer, car dealer, and part owner of an auto auction. Some of the best-known auto publications turn to him for his expert insight. He is also the co-developer of the Long-Term Quality Index, a survey of vehicle reliability featuring over two million vehicles that have been inspected by professional mechanics.

Related articles

View more related articles