Your offer has expired due to inactivity or your browser refreshing.

Thank you for considering a Discover card by Capital One.

So what can you do now? Focusing on your credit health can improve your chances in future.

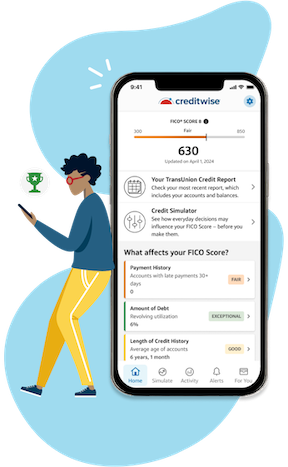

Get your FICO® Score 8, and TransUnion® credit report for free

CreditWise from Capital One is a free credit monitoring tool that can help you learn how to improve your credit score. Generally speaking, the higher your credit score the better the chance you have of getting approved.* With CreditWise, you’re also able to:

- Test the potential impact of several financial decisions on your credit score before you make them.

- Reveal insights that help you see beyond your credit score.

- Stay connected to changes across your credit profile with dual-bureau monitoring.

Already a Capital One customer? Use your existing Capital One username and password for a quicker sign-up experience.

*The score shown above is not your credit score. Image of CreditWise tool shown for illustration only. The credit score provided in CreditWise is a FICO® Score 8 based on TransUnion data. The FICO Score 8 gives you a good sense of your credit health but it may not be the same score model used by your lender or creditor. The availability of the CreditWise tool and certain features in the tool depends on our ability to obtain your credit history from TransUnion and whether you have sufficient credit history to generate a FICO Score 8. Some monitoring and alerts may not be available to you if the information you enter at enrollment does not match the information in your credit file at (or you do not have a file at) one or more consumer reporting agencies. You do not need to be a Capital One account holder to sign up for CreditWise.