Is It Better to Buy or Lease a New Electric Car?

Leasing an EV may seem cheaper, but buying can yield unique rewards.

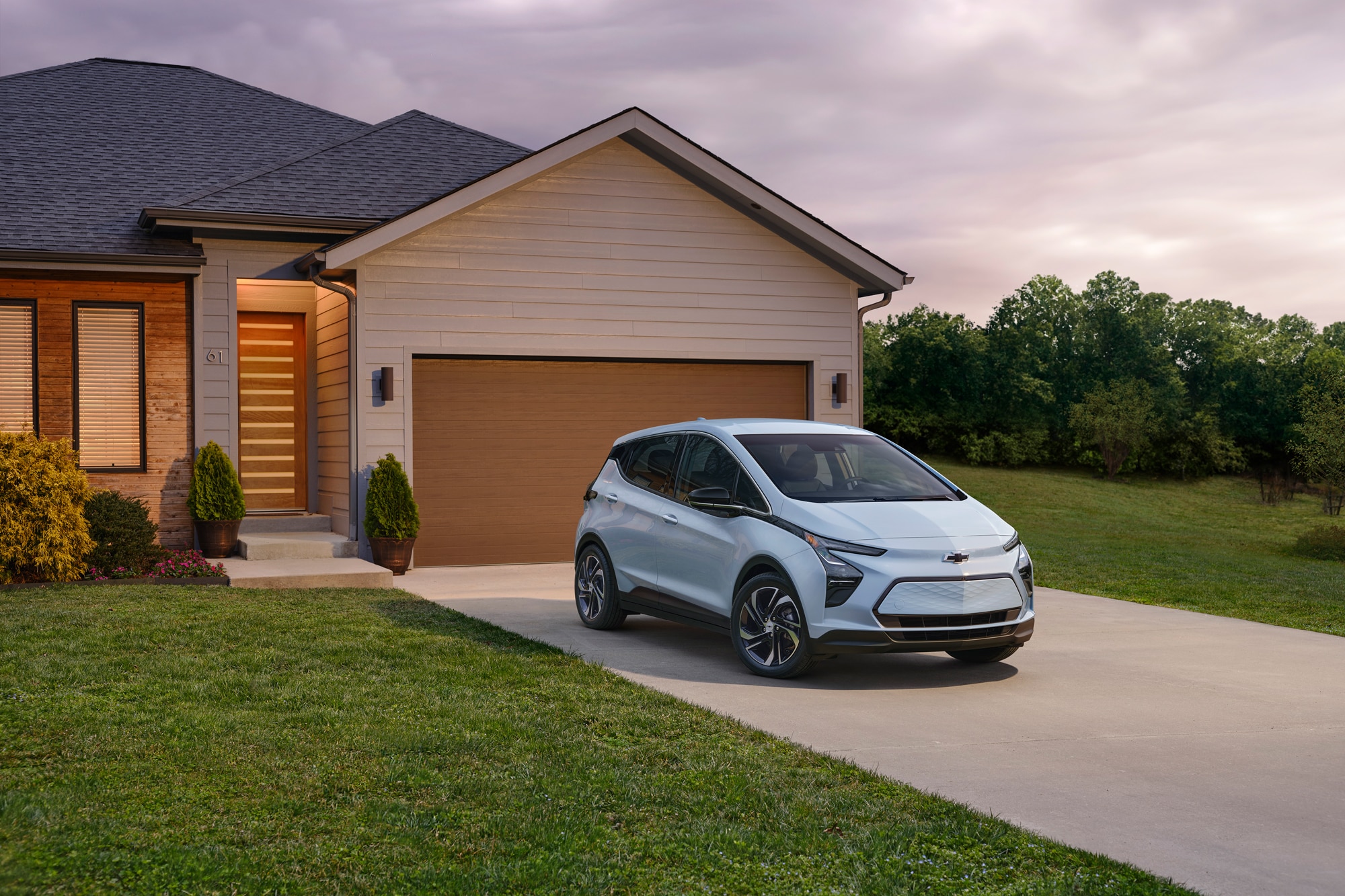

Chevrolet

Chevrolet

Imagine getting a new car for not much more than the price of a couple tanks of gas — and you won't even have to buy gas. That car – the Chevy Bolt EV – is one of more than 100 electric vehicles that will be available between now and 2025. Thanks to generous government subsidies and Tesla’s recent trillion-dollar market value, electric vehicles are riding a wave of popularity, with over $500 billion now planned for their development between now and 2030.

So, should you lease a new EV to try it for a few years? Or buy a new EV and make it a long-term keeper? Read on to learn if it’s better to buy or lease an electric car.

Leasing Can Make Electric Cars Dirt Cheap

General Motors and Costco teamed up last year to offer a super-cheap lease deal for the Chevy Bolt, which ranged from only $110 to $150 a month for 36 months. That didn’t include nearly 200 state and local subsidies, which could range from $500 to more than $5,000 in additional credits for the life of that lease.

Leasing lets you enjoy all the rebates and incentives for EVs over a three-year window. Spread over the lease term, the federal tax credit and incentives could effectively reduce monthly payments by more than $200.

Buying Requires Becoming a Long-Term Electric Car Keeper

Buying outright usually means either paying the full purchase price up front or financing the balance with today’s auto loan rates. If your credit score is 600 or lower, and you take out a six year loan of $30,000, your APR might be 12%. Your payments may end up costing you an extra 40% over the purchase price because of the interest charged over the life of the loan.

If you have excellent credit, these numbers start to work in your favor, thanks to unusually low interest rates starting at only 2.4%. Buying may be a winning strategy in the long run, but only if you choose the right vehicle.

Depreciation Matters a Lot If You Buy a New Electric Car

A 10-year-old Tesla Model S in base model form is still worth 38% of its original MSRP. That means your depreciation costs over the past decade would have been just under $300 a month. That’s less than half the depreciation costs of Tesla’s new-car competitors from Porsche, Mercedes-Benz, Audi, and BMW.

EV owners can come out ahead by keeping an EV, but not always. A 10-year-old Nissan Leaf costs a lot less now. Battery longevity issues in the Nissan Leaf have remained a constant headache for many owners. That base model Nissan Leaf would have also cost more in depreciation than the Tesla Model S; even though that Leaf was more than $20,000 cheaper when it was brand-new.

Choosing a manufacturer that is likely to be around long-term is important when buying a new EV. If you decide to lease, the risk of losing money through depreciation doesn’t exist. But if you buy, you’re not just buying a car. You’re also choosing the one manufacturer who will be supporting your vehicle as it ages. So do your research and figure out whether you want to lease for now, or buy for the long-term.

Written by humans.

Edited by humans.

Steven Lang

Steven LangSteven Lang is a special contributor to Capital One with nearly two decades of experience as an auto auctioneer, car dealer, and part owner of an auto auction. Some of the best-known auto publications turn to him for his expert insight. He is also the co-developer of the Long-Term Quality Index, a survey of vehicle reliability featuring over two million vehicles that have been inspected by professional mechanics.

Related articles

View more related articles