The Truth About Auto Loan Calculators

How to get the most accurate info out of online calculators.

Capital One

Originally published on April 2, 2018

Article QuickTakes:

Trying to negotiate with a dealer based on monthly payments is a common mistake, but it’s still important to have a general idea of how much you can expect to pay each month. That’s one of the reasons why people search “auto loan calculator” more frequently than simply “auto loan,” according to Google.

If you’re looking for a new or used car, there’s a good chance you’ve already come across some sort of auto loan calculator. There are a bunch of variations out there, but at their most basic level all of them do similar things.

And they can only be as accurate as the numbers you plug in.

CALCULATORS ARE GREAT, BUT NOT PERFECT

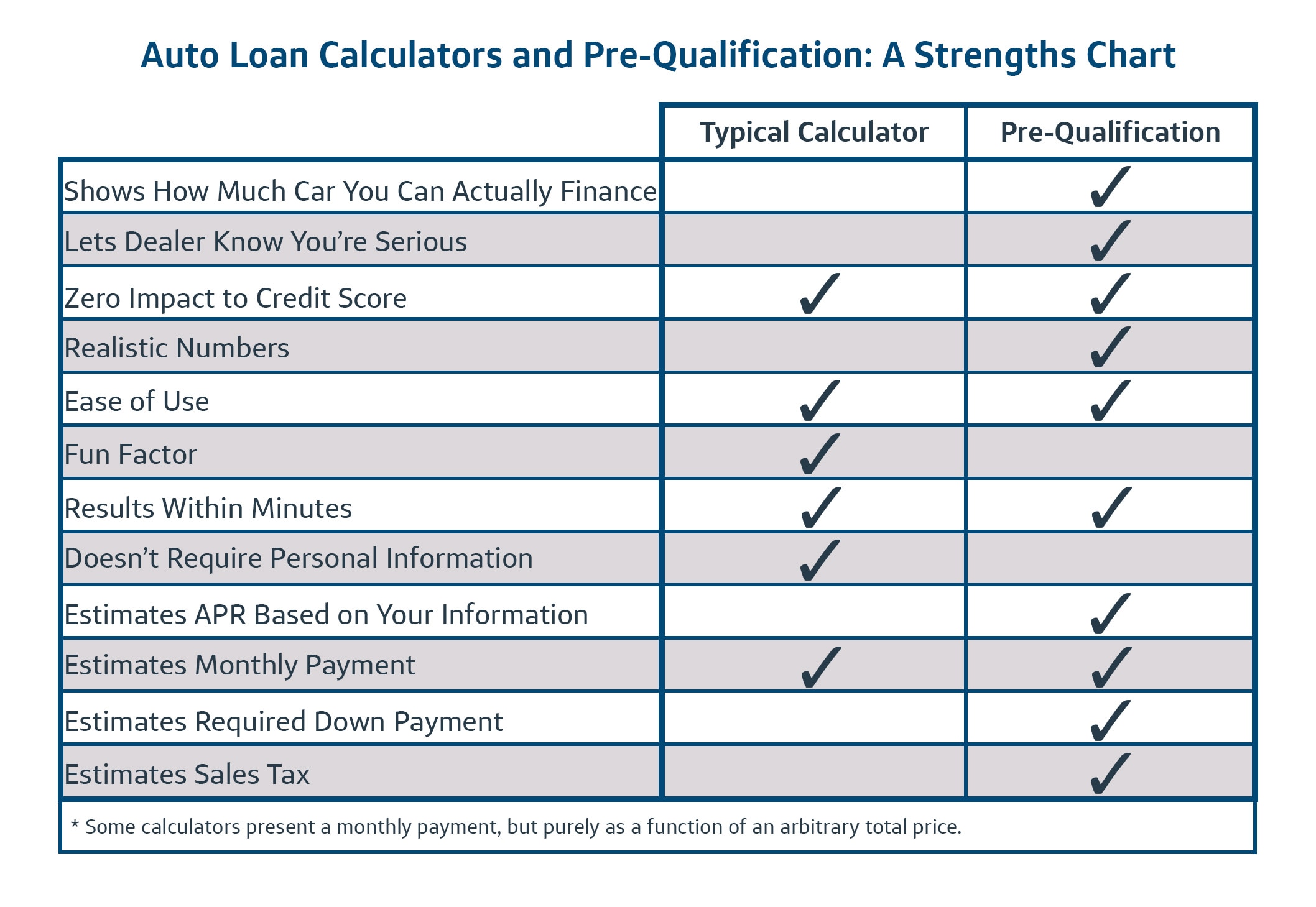

Depending on which calculator you use, it can spit out a variety of important numbers. Most will give you some kind of monthly payment estimate. Some can work backwards and attempt to tell you the maximum price you can afford based on what you’re willing to pay each month. A few even attempt to take sales tax into account. However, there are two crucial bits of information that calculators tend to leave to you:

- Your actual annual percentage rate (APR)

- Whether or not you would qualify for a loan in the first place

There is a very strong chance you don’t already know what APR you’ll qualify for. Some calculators recommend plugging in a default rate (or automatically do it for you), but that rate is frequently available only to people with exceptional credit. That’s a big deal, because without knowing your APR no calculator can give you an accurate answer.

The situation gets even more complicated when you try to figure out if you can even get such a loan approved. You might be comfortable committing to a $37,000 car, but that doesn’t mean a lender will let you borrow that much.

Simply put, calculators don’t really give you answers unless you already know exactly what kind of terms you can qualify for. There is, however, a way to find that information without applying for financing. This is where pre-qualification comes into play; in about the same amount of time as it takes you with most calculators, you can get real numbers. Should you still feel the need, you can then use your new, more accurate pre-qualification numbers to improve the results of your preferred calculator.

THE DIFFERENCE BETWEEN PRE-QUALIFYING AND APPLYING IS HUGE

A lot of lending companies would rather you formally apply for financing first and get answers later, but that involves the kind of “hard pull” that could have a lingering impact on your credit history (especially if you opt not to buy a car right now). Avoiding this exact scenario is one of the main reasons to pre-qualify for a loan. That’s also why several different lenders—ahem, yes, that includes Capital One—will allow you to do so online.

When pre-qualifying, you enter some basic information: name, phone number, social security number, etc…This is the kind of info nearly any lender would need when deciding if you’re capable of paying back the loan. When you’re done, you’ll have a realistic set of APR and loan amount figures on which to base your calculations without potentially hurting your credit score (since it counts only as a so-called “soft inquiry”).

THERE ARE IMPORTANT—AND FUN—REASONS TO USE AN AUTO LOAN CALCULATOR

Despite their inherent limitations, auto loan calculators still have merit. When used in conjunction with the numbers you get from pre-qualifying, calculators can be incredibly useful tools. They are also surprisingly fun, especially if you like hypotheticals:

How much more car can you afford if you just cut cable TV out of your budget?

Or if you dine out less frequently?

What if you did both!?

The possibilities are as open as your imagination.

If you start with accurate numbers, a good auto loan calculator can help bring a greater degree of understanding to an unresolved issue. For example, if the car you’re considering is $30,000, how much will your monthly payment be? How does that payment change if you finance for 48 or 60 months instead?

These are very valid questions to answer prior to setting foot on a dealership lot. Using both a calculator and pre-qualification are two great ways to get your questions answered.